Attract Qualified Renters

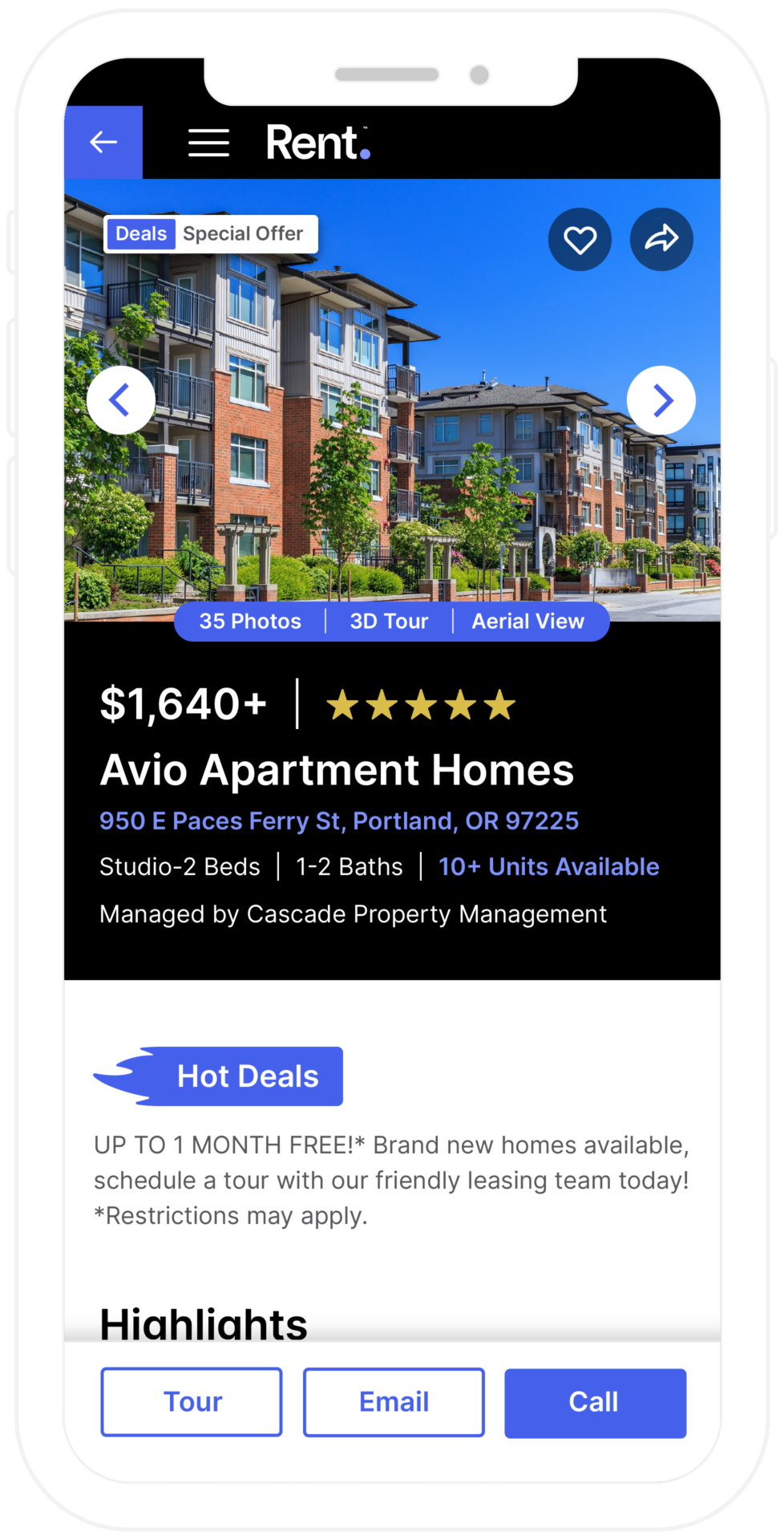

Renters are more likely to discover your property first on an online marketplace than your property website. From there, it’s about getting tours booked.

Attract high-quality leads that are ready to tour–and ultimately sign that lease–with listings that make the most of your budget and time. Property owners and managers receive access to over 350 million website visits¹ each month through our RentMarketplace. network and strategic agreement with Realtor.com. You can even reach in-market renters with search ads, social ads and email marketing solutions that are powered by our marketplace.

Meet Your Next Resident

Inspire renters to take action and boost your property’s brand.

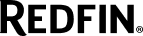

RentMarketplace. ®

Renter-centric search experiences to find your newest residents.

- Access to 350M+ visits each month through our Rent. network and strategic partnership with Realtor.com.

- Attract and engage renters with videos, virtual tours, online applications, and included photoshoots.

- Easily manage listing content, tools and performance reports with the RentHQ. client portal.

- Stand out to renters in their search with Profile Sync, which effortlessly syndicates property data and images on your Google listing.

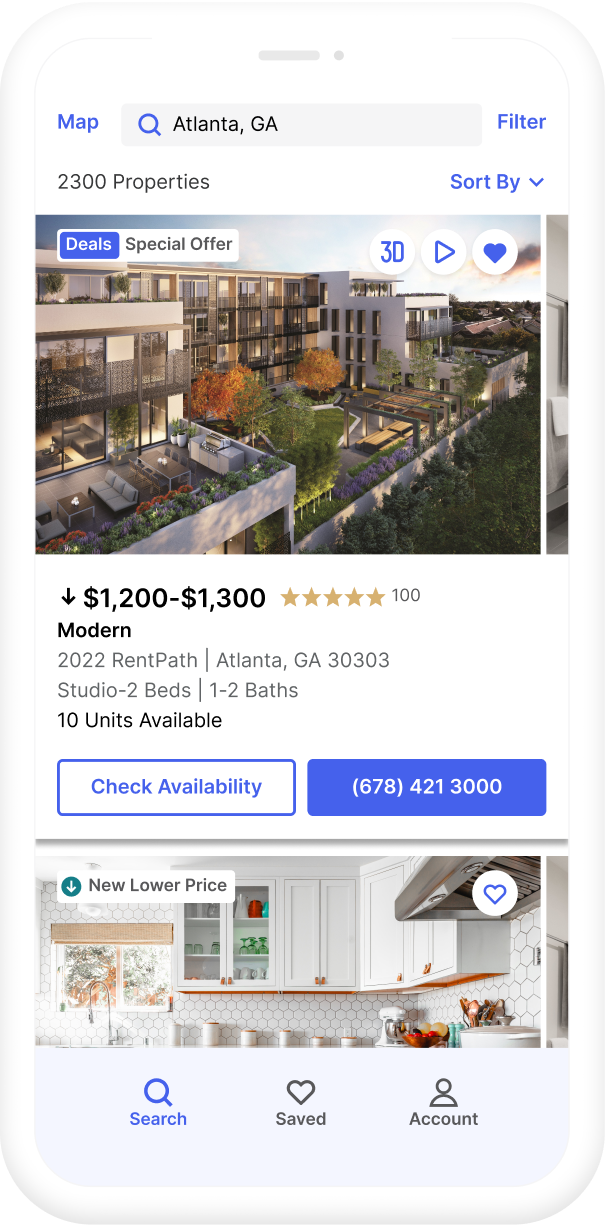

RentSocial. TM

Fair-housing compliant social ads that generate high-quality renter leads.

- Rent. reaches 50x more in-market renters than traditional targeting with hyper-targeting powered by our unmatched proprietary data from RentMarketplace. visitors.⁵

- Choose from turnkey ads that go live in as little as 24 hours or custom strategy based on your specific campaign needs.

- Reach renters like never before on Facebook, Instagram, Snapchat or TikTok.

- Deliver in-market renter leads directly to your property management system with campaigns powered by unmatched proprietary data.

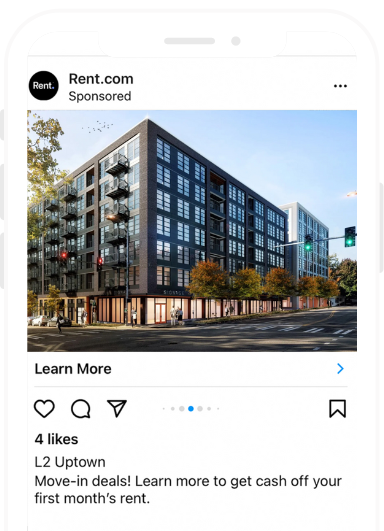

RentSearch. TM

Award-winning Google search campaigns that keep occupancy rates high.

- Unparalleled lead quality and website traffic powered by the Rent. marketplace network.

- 3X higher click-through rates than the industry average.⁶

- Simple, transparent pricing.

Be a leasing legend.

Learn how WestCorp boosted occupancy rates to 99% with Google PPC Ads powered by our unmatched proprietary data on in-market renters.

Serena Y. from WestCorp Management Group found a better way to bring in qualified renters.

• 34% higher conversion rates

• 15-20% higher click-through rate

• 98-99% occupancy rates

Make Resident Connections Count

Simplify communications and automate repetitive tasks for your property team.

RentEngage. ®

Your leasing team’s key to communicating with renters and residents stress-free.

- 24/7 leasing center support handles incoming calls, emails and online chat.

- Trusted, FHA-compliant solutions safely answer questions, book appointments and qualify renter leads.

- Nurture prospects and residents to lease and renewal with automated, two-way text and email messages from a centralized platform.

RentRep. TM

Take control of your online reputation and social presence to boost renter engagement and SEO.

- Fair Housing-trained experts handle your review responses and social media.

- Effectively manage reviews, social, listings, surveys and more with a best-in-class dashboard powered by Reputation.

- Deliver fast and personalized responses to resident reviews.

- Highest-rated reputation management solution available.

Target intelligently

Boost your efforts with hyper-targeted advertising solutions powered by our proprietary in-market renter data.

RentTarget. TM

Reach the right renters with targeted display and email campaigns.

- Sophisticated targeting that drives 3X more clicks⁷ from in-market renters.

- Get in front of renters right when they step into your area with geo-fencing technology.

- Fair Housing trained experts to safely maximize your reach with in-market renters.

Frequently Asked Questions

Got questions? We have answers.

We’re here to simplify your entire leasing lifecycle, whether you’re building your property’s brand, attracting and converting new renter leads, or nurturing current residents for renewals. The Rent. platform powers a full suite of best-in-class digital marketing solutions across search advertising, social media, email marketing, web chat, resident communication, reputation management and more. Powered by unmatched proprietary data from our marketplace, Rent. solutions allow you to reach high-intent renters who are actively searching in your area. With the fastest search speeds¹ , we help home seekers quickly find your property and request a tour on RentMarketplace. Property owners and managers receive access to over 350 million website visits each month through our RentMarketplace. network and strategic agreement with Realtor.com. The RentMarketplace. network includes Rent.com, ApartmentGuide.com, Rentals.com and Redfin.com. Wondering what happened to RentPath? That’s us! Learn more about our upgrade to Rent. and our new and improved capabilities here. ¹ Google Pagespeed Insights, Data based on 5 major U.S. markets, June 2022.

Though we are recognized for our vast reach across a network of listing services, Rent. is here to take the hassle out of the entire leasing lifecycle for property owners and operators. Think of us as your go-to for attracting new renters, engaging prospects during their search for a place, and nurturing resident relationships. Our property marketing and advertising solutions allow you to generate awareness around your property brand, get in front of in-market renters, and capture new renter leads. Our marketing solutions include:

- RentSocial.: social ads on Instagram, Facebook, and the industry’s first and only advertising for Snapchat

- RentSearch.: paid search ads (PPC) on Google

- RentTarget.: display ads, geofencing and email marketing

- RentRep.: online reputation, listing and social media management

- Virtual leasing center: 24/7 support for phone and email, voice AI assistance, and chatbots for your property website

- Centralized digital marketing platform: offering automated, two-way text and email messages

Rent. supports property owners and operators all across the United States. We have a diverse and connected team of remote and in-office employees, and our headquarters is in Atlanta.

Let’s get you set up! Complete the form on our Contact Us page and our team will connect with you as soon as possible to talk through your needs. We look forward to hearing from you.

Our network is stronger than ever, with over 350M website visits each month across our sites (rent.com, apartmentguide.com, rentals.com and redfin.com) and through our strategic agreement with Realtor.com. The new Rent. is much more than a marketplace. Whether you’re building your property’s brand, attracting and converting new renter leads, or nurturing current residents for renewals–the Rent. platform is here to take on your biggest challenges. With unmatched audience targeting fueled by proprietary data from the RentMarketplace, you can reach in-market renters through a combination of tactics that works best for your team. Search, social, display and email advertising tools save you budget and time by seamlessly integrating with your marketplace listings. That said, we’ve also optimized our renter-centric marketplaces. And with the fastest search speeds, we empower home seekers to quickly find your property and request a tour. We’re also thrilled to introduce Profile Sync, which seamlessly manages your Google Business Profile and has proven to more than double actions taken on the profile listing. We’re focused on the future of your property. Rent. will continue to innovate and remove friction for both clients and renters alike with the addition of new features like configurable, templated property websites to further amplify Rent. clients’ online presence.

You still have the same pricing, access to powerful solutions and quality customer service that are part of your plan. Your MyRentPath account has been upgraded to RentHQ, where you can easily access all of your solutions and reporting. New names for our solutions are as follows:

- Network advertising (including Silver, Gold, Platinum and Diamond level packages) is now RentMarketplace.

- Search Ads Express and Pro are now RentSearch.

- Social Ads Express and Pro are now RentSocial.

- Geofencing, Display, LeadMail are now RentTarget.

- Contact Center Express and PRO, and Media Center are now RentEngage.

- Community Reputation Express and PRO are now RentRep.

You can reach us by phone at 877.999.4472 from 9:00 am to 6:00 pm EDT. Or shoot us an email at customersuccess@rent.com.

We’re happy to help! Call us at 866.236.2510 to talk through your billing questions.

We are Rent. TM

a Redfin Company

We’re here to simplify your entire leasing lifecycle, whether you’re building your property’s brand, attracting and converting new renter leads, or nurturing current residents for renewals.

¹ comScore, Jan 2023 – Mar 2023

² Internal Data: 12 month average Leads per Property, May 2021 – Apr 2022 vs May 2020 – Apr 2021

³ Internal Data: 12 month average Leads per Property, May 2021 – Apr 2022 vs May 2020 – Apr 2021

⁴ Internal data, Sept 2021

⁵ Based on census.gov population statistics and the Rent. 2021 Renter Survey data. Assumes a 12-month average lease duration, renter population that is 18+ years old and the same pricing offered across social ad providers.

⁶ Internal Data Dec 21 Apr 22 compared to Wordstream Google Adwords Industry Benchmarks, February 2022

⁷ Invesp, April 2022